When it comes to paying taxes, no one likes to be surprised. However, businesses may be in for a bit of sticker shock this tax season. The enormous rise in property taxes across the country over the past decade has been well documented and discussed in both local and national news, but that doesn’t make the huge numbers coming from the tax assessors sting any less. Much of the property tax discussion in the pop culture sphere has revolved around homeowners and their residential properties – but what about business properties and the companies that own them?

In many states, companies must pay property taxes on all tangible personal property that is used to produce income in the state. Tangible personal property refers to assets such as furniture, fixtures, inventory, equipment, vehicles, and more – essentially, if your business owns it and it’s in the state, they’re going to tax you on it. These business personal property taxes are administered by the tax assessors, which are responsible for assessing the value of properties and collecting taxes on them each year. While many jurisdictions handle the assessment process in-house with their own staff of assessors, others utilize third-party consultants to calculate property values.

With the United States currently experiencing historically high rates of inflation, we are seeing an increase in the index factors used by these third-party consultants across the board, with some showing a significantly higher increase than in previous years.

Discussing these rising costs, Tax Advisors Group’s Senior Director of BPP Consulting Chad Wallace said, “When using these higher trend factors, we are seeing some values becoming higher than they were in the previous year.” He went on to say, “Index tables are very high this year compared to prior years, adding that “trend factors are around 20% higher than prior years.”

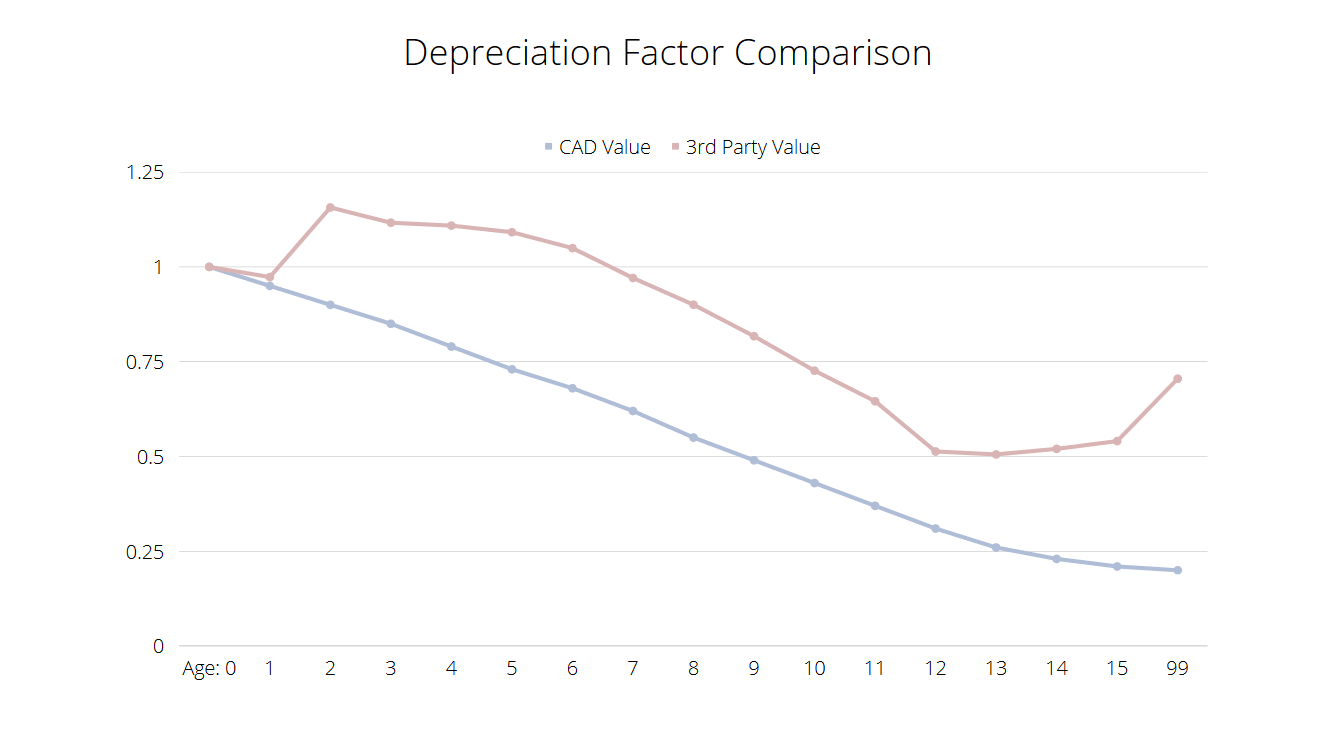

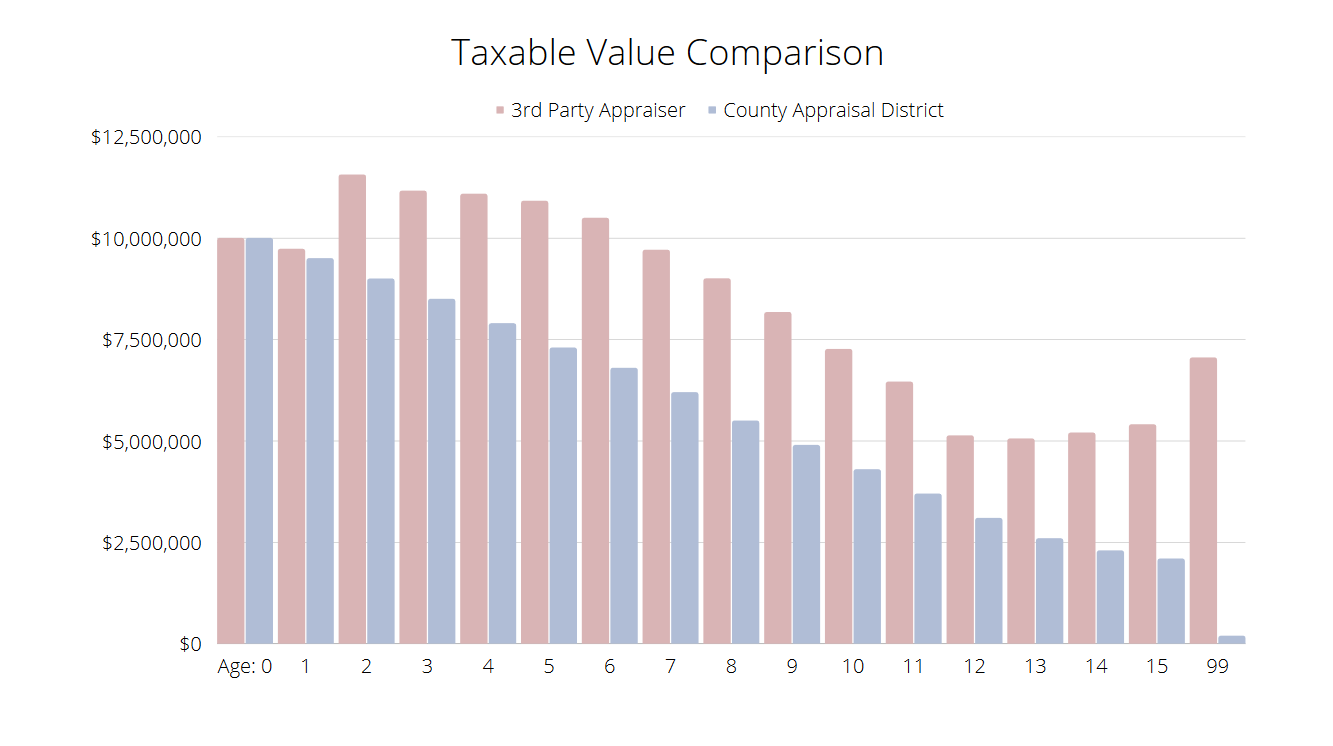

According to Mr. Wallace, “The inflation increases from prior years have caused the appraisers to raise the index factors used to bring a fixed asset to what they consider the ‘replacement cost new’ prior to applying their depreciation factor.” These inflation-driven increases in index factors directly impact the values assessed for taxpayers. “This has caused their starting value prior to depreciation to be higher than what a property owner paid for an asset, and this can cause an asset to be valued higher than what it was assessed for in the prior year,” Wallace said.

This is important to note for businesses with property in the states that tax business personal property because it means that assets may be valued at higher than what they were originally paid for under the third-party consultant’s tables. In fact, Chad Wallace said that Tax Advisors Group (TAG) even has “a few clients that did not have any change in their taxable fixed assets from the prior year, but because of the third-party consultant’s higher index factors for the current year, their market value (per the assessor) was higher than the year before.”

For many taxpaying businesses, opening that envelope from the assessor with their property’s taxable value for this year may be shocking. However, those values are not set in stone. With a little help, you can lower your tax liability while maintaining compliance with state and local regulations – that’s where TAG comes in.

At TAG, we fight to have your assets valued at fair market value instead of relying on the tax assessors’ – or in this case, the third-party assessors’ – depreciation tables (which aren’t published). We look closely at market dynamics by area and property type to gauge what fair market value for your property actually is, and we look at our clients’ individual property characteristics such as age or condition to determine what a true and fair value would be if you were to sell that property in today’s market. Additionally, even if a property appears to be assessed in line with market value, we check to make sure that it’s assessed equally with comparable properties. This approach to our clients’ taxes allows us to ensure that your properties are valued fairly and that your tax bill reflects the fair market value, leading to an average reduction in taxable asset value of 30%.

Nobody wants to pay exorbitant property taxes each year. With historic inflation, rising property values, and higher index factors used by third-party consultants, avoiding an increased tax bill can be difficult. However, through Tax Advisors Group’s proprietary approach to business personal property taxes, savings are not only possible – they’re achievable. Our team of property tax experts is prepared with the market data, experience, and technology necessary to achieve the tax, and ultimately expense reductions your business demands.

To learn more about how TAG can support your business and minimize your property tax burden, contact us today.